What is a HELOC?

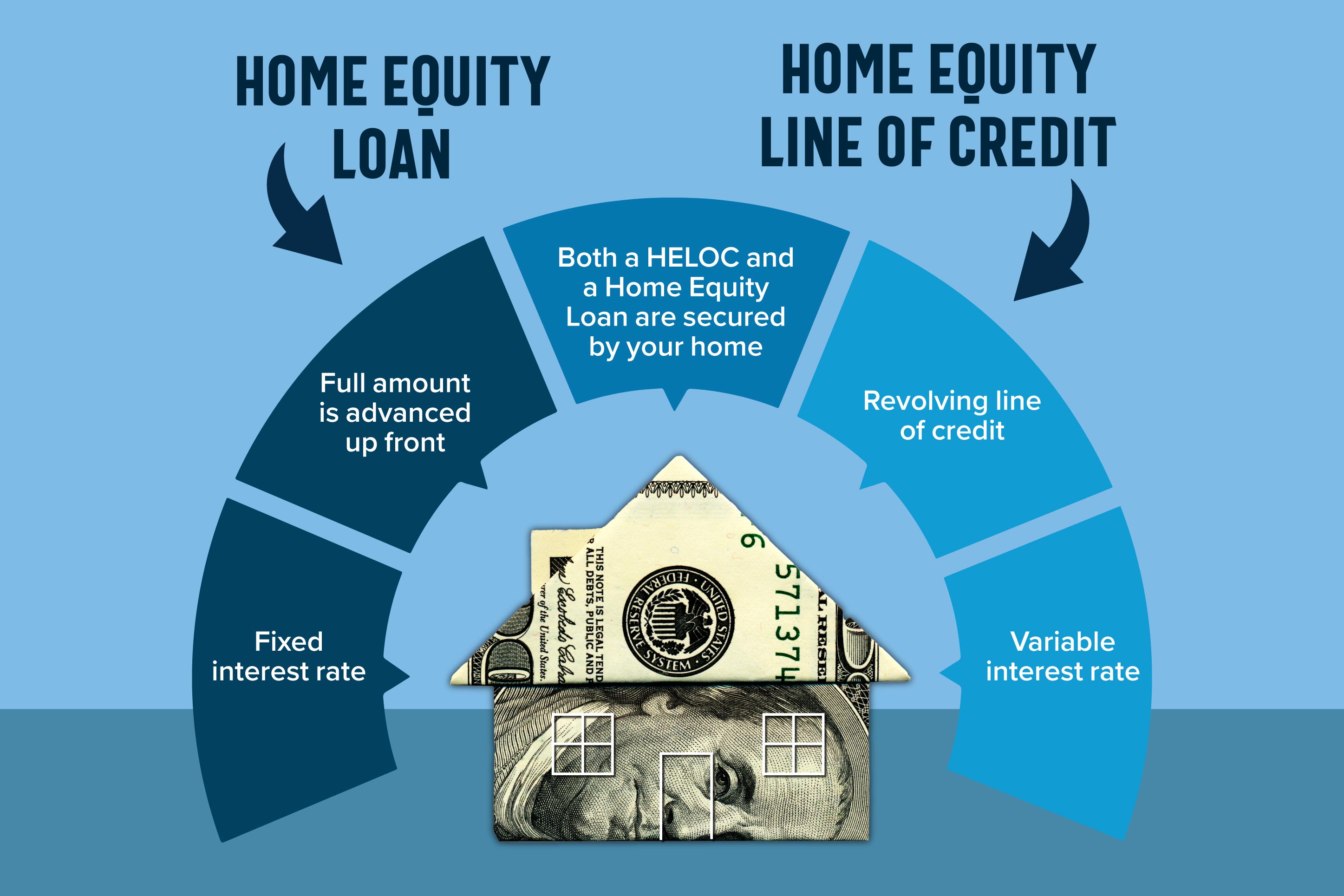

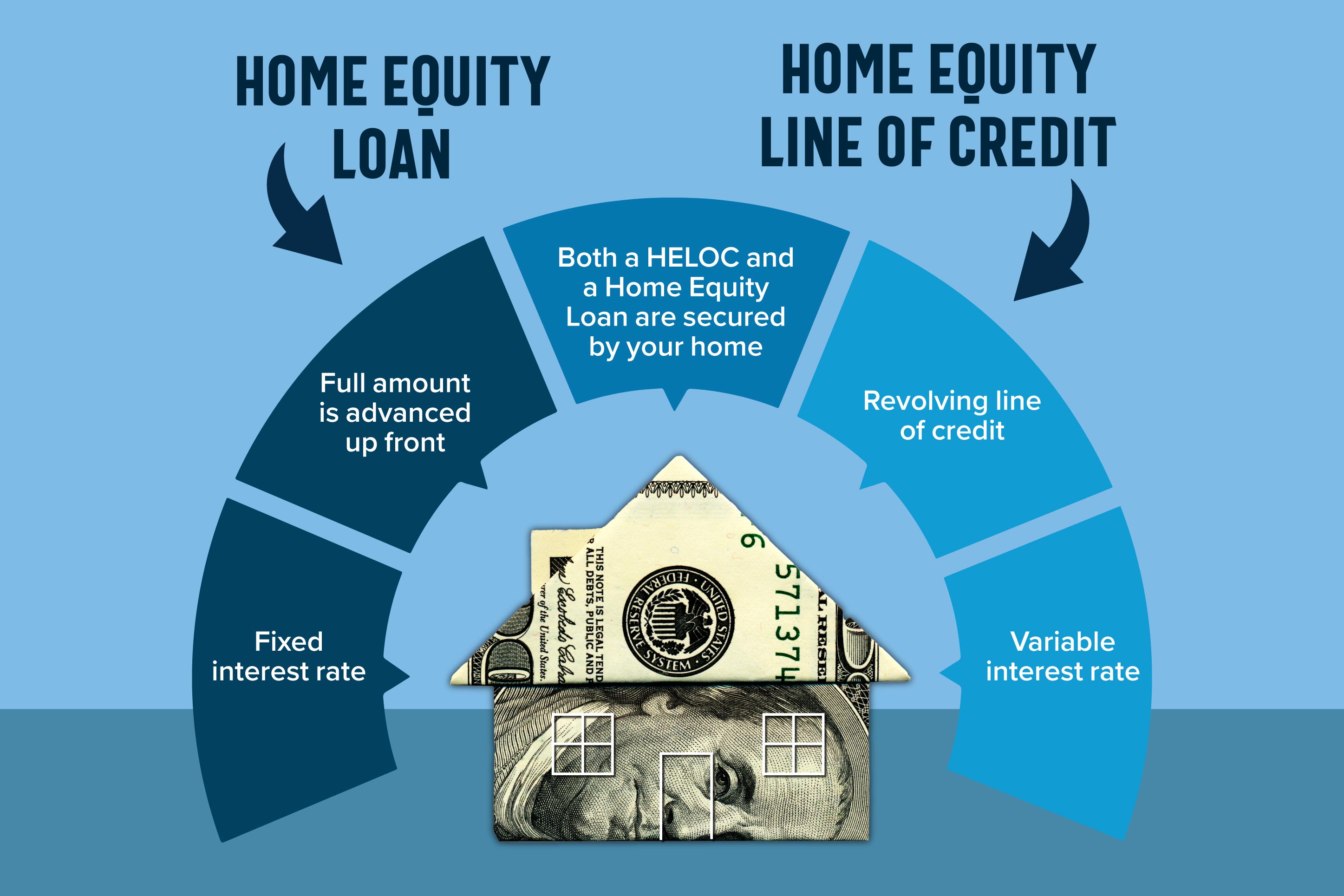

A HELOC is a line of credit, with your home equity used as collateral, that functions a lot like a credit card. You can draw from it as often as you want once you open it. And like a credit card, it’s a revolving line of credit. So once you pay it off, you can use that money again. They have a variable rate, and don’t always have fixed monthly payments. You can make lower payments initially, just paying interest, with a higher monthly payment when you start repaying principal. They typically have a 15-year term.

What is a Home Equity Loan?

A home equity loan, on the other hand, is a one-time, lump-sum loan used for a particular purpose, and you’ll usually get all the money up front. It also is secured by the equity you hold in your home. They have fixed rates, and fixed monthly payments. You can choose a loan term that works best for your budget and circumstances. Because the equity in your home is collateral for the loan, home equity loans are often called second mortgages.

How can you use a Home Equity Loan?

Whether you have major remodels to take care of, debt consolidation, or other large expenses, you can usually use a home equity loan if you qualify. Since it borrows from your home’s value, it’s often a good idea to use it to increase your home’s value (like with a remodel). But you’re not limited to that.

Who issues a home equity loan?

You can typically find lenders in both banks and credit unions. Of course, a credit union like RMCU comes with the benefit of community decisions, community backing, and local support.

How can you get this type of loan?

You will need to have some equity built up in your home to use it to secure a home equity loan. Your home’s equity is the difference between what you owe on your mortgage and the value of your home. The amount your lender will issue depends on your Loan to Value Ratio (LTV). That’s just the amount of your existing mortgage divided by the value of your home, giving you a percentage that represents the risk a financial institution takes on by granting another loan. You will have to pay some fees associated with the loan, but they are substantially less than on your original mortgage. Think hundreds of dollars versus the thousands on your first mortgage.

Once you have the equity, securing a home equity loan with RMCU is as easy as a simple online application. Or if you’d rather have the personal touch that comes from meeting with a real person, you can go into your nearest branch to talk to a lending pro. Reach out now to see where your home can take you.