Help Them Practice Saving

One of the best ways to get kids to learn about savings is to have them actually save. You can open their first savings account with them and show them how to make deposits. Maybe they deposit a few dollars of each allowance or birthday gift as they save for something bigger. Make it fun, with milestones to hit and fun rewards, so they understand the value of saving their money.

Show Them How to Budget

Getting kids involved with budgeting teaches them real-life skills that they’ll carry with them into adulthood. You might assign them household bills to pay, with a set stipend to work with. Or give them an allowance for items you would pay for anyway, like clothing or school supplies, and let them save and spend on their own.

Talk About How Credit Cards Work

With credit cards making up 27% of payments in 2020, spending with plastic is almost a given in this day and age. By helping your kids build a healthy relationship with credit by instilling good spending and payment habits, you can guide them to a solid financial future. Start off with advice to only spend what they can afford to pay back each month, and to make on-time payments every time. As they get older, you might encourage them to get a secured credit card or one that you co-sign with them to help build their credit too.

Make Sure They Understand Loans

Loans are a big part of life for many people, including young adults getting ready to take out their first student loan. Helping your children understand how they work and what interest means to the total cost can give them a leg up as they navigate loans for education, cars and eventually, a home. You might want to show them the process of paying your own loans back each month, or have them calculate what the total interest cost on your family car will be. When the time comes that they want an advance on their allowance, you can even draw up a loan agreement with repayment terms and interest, and let them decide if the extra cost is worth it to them before they sign.

Give Them an Up-Close Look at Interest

Interest applies to a lot of financial areas, from credit cards to loans and compounding interest on retirement accounts. When your kids are old enough to do the math, give them the formula for compounding interest and let them see how much their savings account will be worth with their interest rate in 10, 20, or 30 years. For example, $100 in the bank for 10 years in a Rocky Super Saver account at .05% APY will turn into $164, all on its own. And they’ll be looking at $1,211 after 50 years.

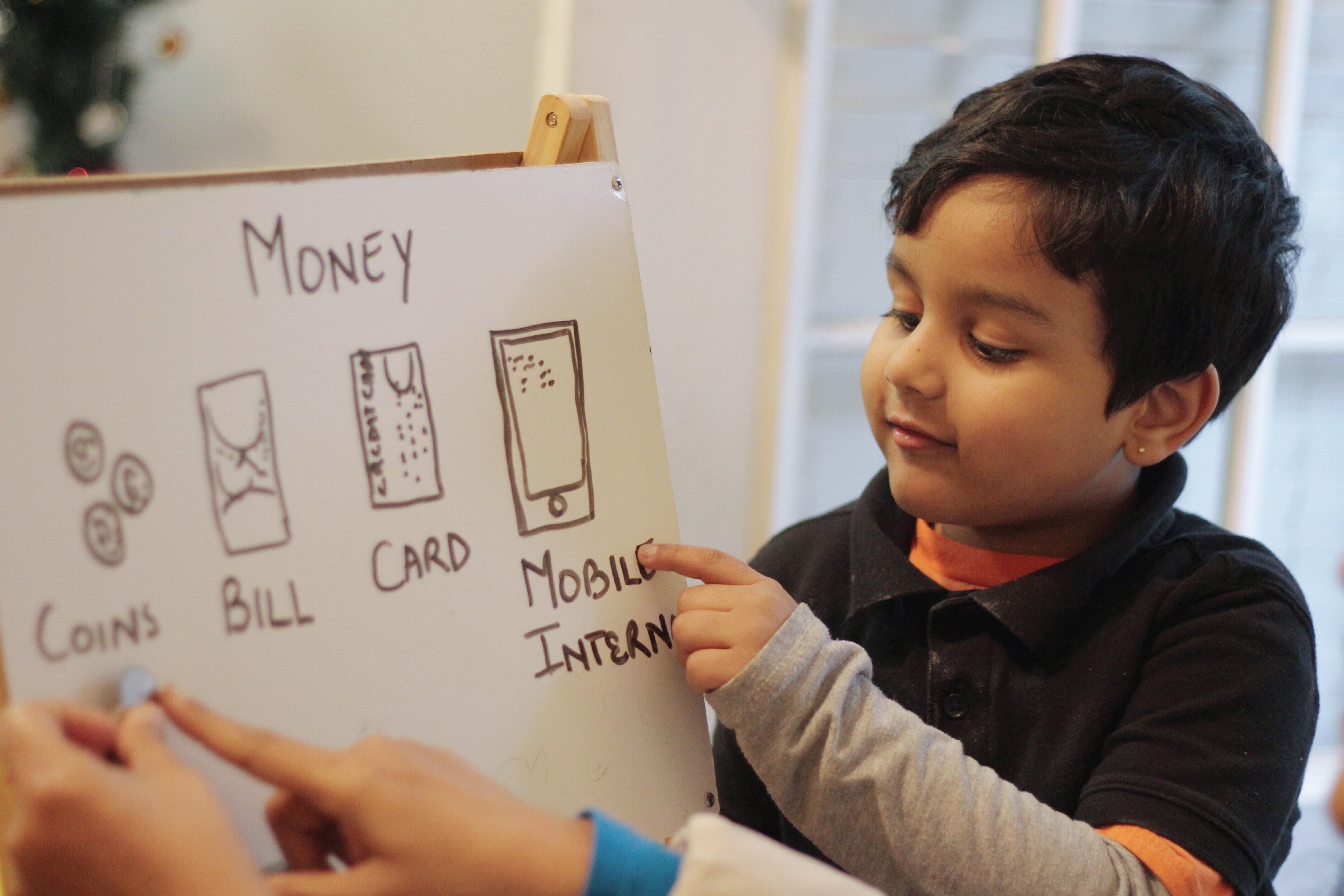

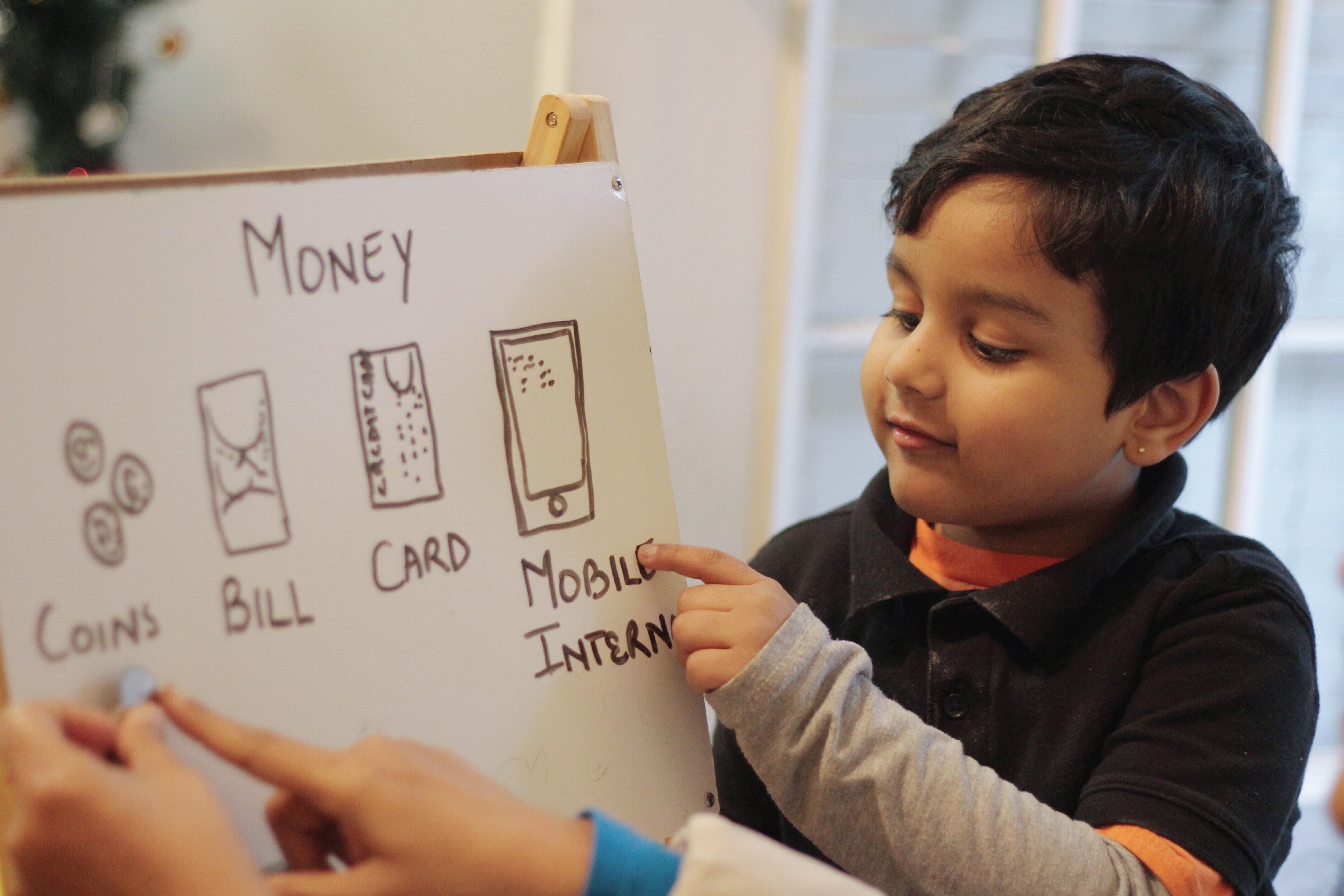

Find a Finance Game

With tons of apps and online finance games out there, it’s easy to give your kiddos a fun look at finance while they play. Get them set up with a stock market simulator to use fake money in real-time market trades. And there are plenty of others for everyone from pre-K, all the way up to adults. Let their playtime help them learn, and set them up for a fun financial future.

For more financial education resources, the rest of the RMCU blog can set you on the right track. And when it’s time for your children’s first saving accounts, we’ve got you covered with community-focused accounts for Montanans.

If you enjoyed this blog, you might enjoy these other related blogs: