DO's:

Create a Business Plan

Nothing shows potential investors you're serious like creating a business plan. When you're pursuing funding from investors, we'd recommend going with the traditional business plan format mentioned here by the US Small Business Administration to give potential investors as much information as they want, right off the bat.

According to the SBA, you'll want to include some combination of an executive summary, company description, market analysis, organization and management, service or product line, marketing and sales, funding request, financial projections, and an appendix. Strike the balance that's right for your business, and wow investors. Also, leave the pitch for the elevator; your business plan is the roadmap to success, not the personality behind the brand.

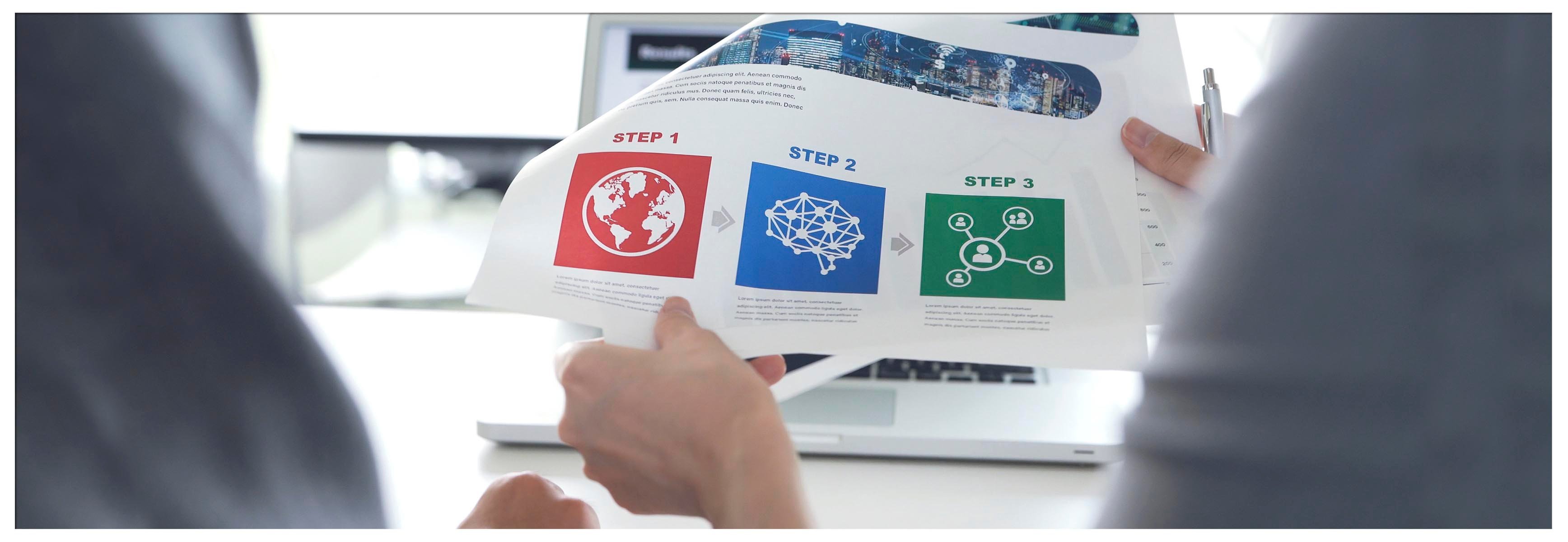

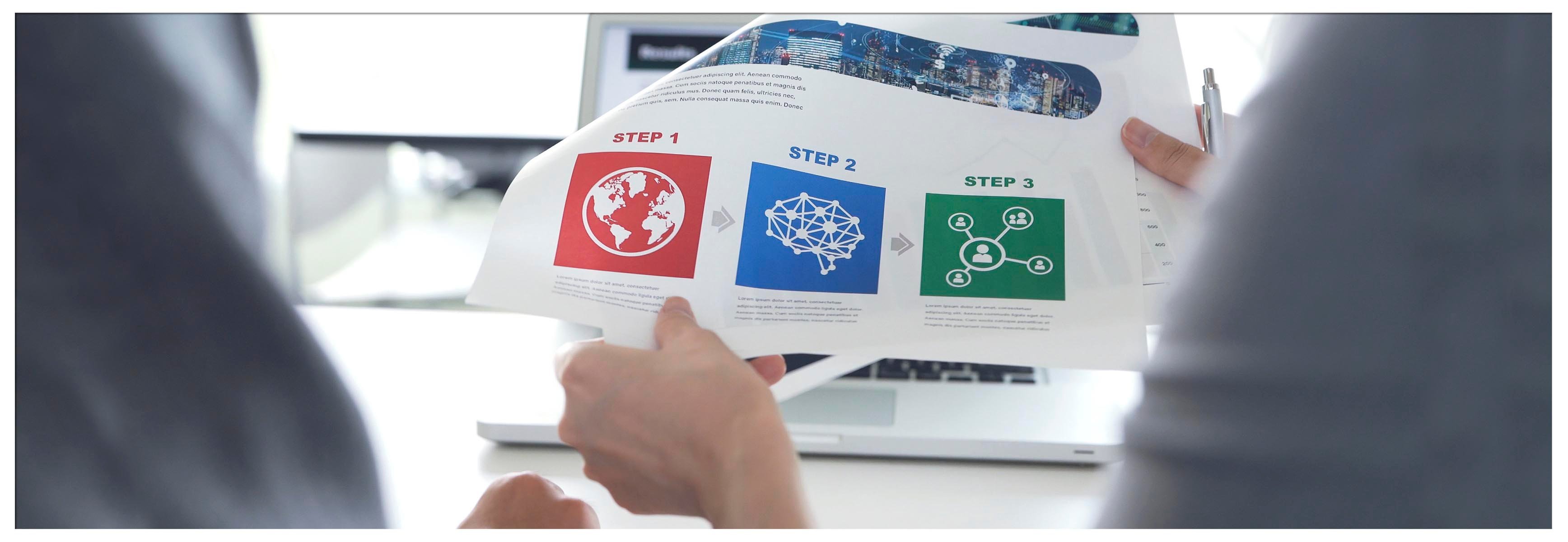

Be Prepared with a Proof of Concept

A proof of concept (or PoC) helps prove that your business idea is truly feasible and will be viable in the market. It's a good idea to run through this whether or not you're ready to search for investors since it can help guide you through the first steps of startup. But you'll definitely want to have your PoC in hand when you set out to get funding.

This might entail competitor information, market trends, or methods of execution that support the model you are going forward with. Also, if you are going to an equity firm over a single investor, this is a discussion piece that they will want to advise you in. As their primary interest is maximizing their return, the advice they give is usually worth its weight in gold.

Research the Investors or Equity Firm

This is Job Search 101, and it still holds true when you seek investors for your own business: do your research. Find out all you can about the investors or firm you're pursuing so you can tailor your pitch to the people you're talking to. Find out their interests, their backgrounds, what they're looking for, and then show how you fit in.

Many angel investors and venture capitalists are harder to get to know on the front end, so researching the companies they have helped succeed gives you some understanding of what they look for. Usually, it is a bit easier with a private equity firm or a VC firm, as they are usually more public with their successes, as well as their requirements to take a meeting.

DON'Ts

Be Vague About The Funding Need

If you're ready with your business plan, you should know what you need to get off the ground. Be honest about it. They're here, in this meeting, to get down to the numbers. It's your job to deliver, so don't waste their time — and yours — by beating around the bush.

A vague set of numbers shows the investor that you're not prepared to lead the way you should, and usually ends with a very easy "No" on their side. Remember, they are serious about getting their money back with the percentage goal they are looking for. If you are obscure about the need, it lowers your credibility to invest in and the viability of the return.

Act Like Your Venture is a Sure Bet

There's confidence, and then there's cockiness. You want to convey yourself with confidence, but that doesn't mean your business is guaranteed to succeed. If there's one thing about the life of an entrepreneur, it's that nothing is for sure. You don't want to come across as over-confident or make it harder on yourself by setting unrealistic expectations.

Most ventures fail. Investors who make their living, using their resources for return, have a more realistic understanding of this than most entrepreneurs do. Succeeding at a startup is a hard row to hoe. If you are distracted by the competition, the details, the business, the non-essentials, etc,... you are bound to fail. A laser-focused entrepreneur on what needs to be done goes a lot further than one who pretends the investor will be missing out if they don't get involved.

Go in Cold Without Practicing Your Pitch

You don't want to sound like you're reciting lines from a script, but you also don't want to stutter and stumble over your words so much that they tune out before you even get to the good stuff. So practice your pitch a few times before you're in the room. Make sure you know it inside and out, forwards, backwards and upside down, and then let go of perfection.

There is a reason they call them elevator pitches. You should be able to make it in the time you could talk with someone while the elevator went up to their floor. Make your delivery conversational but polished, and you're ready to go. Also, make sure you are the right one to do the pitch. Maybe you're the co-founder with the brain that makes it work, but not the outgoing personality to drive interest. Know your limitations, and use the right people to help you meet your goals.

There you go; just a few tips and tricks on landing an investor. Remember, this is only the first win in a series of them that you will need to find success. Be humble, be prepared, and surround yourself with partners who help you reach your goals. For more support as you launch your business, click here to investigate some of RMCU's small-business loans or talk with Alan or Connie on our Business Services team.

For more tips on a variety of topics, check out the rest of our blog here.